new mexico pension taxes

New Mexico Tax Breaks for Other Retirement Income. AP Sonya Smith head of the New Mexico Department of Veterans Services said she will step down Friday to spend more time with her family.

States That Don T Tax Social Security

Nebraska does not tax Social Security benefits for couples who file a joint return with an AGI of less than.

. New Mexicos law says every person who has income from New Mexico sources and who is required to file a federal income tax return must file a personal income tax return in New. Governor enacts tax cuts for New Mexico seniors families and businesses. NEW MEXICO CUTS THEIR TAXES ON RETIREE BENEFITS.

Low-income taxpayers may also. Like the federal tax system the Land of Enchantment uses brackets. Robust digital tools data-driven insights.

Taxpayers can also deduct up to 12127 24524 for joint returns of interest. Between 1946 and 1952. Up to 20000 of retirement plan income is exempt up to 40000 for joint filers.

Disabled Veteran Tax Exemption. Beginning with tax year 2022 most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns. The state tax form contains a spreadsheet to calculate the difference.

Ad Free 2021 Federal Tax Return. 52 rows 40000 single 60000 joint pension exclusion depending on income level. Total active members of the New Mexico Educational Retirement Board.

Is my retirement income taxable to New Mexico. Federal adjusted gross income cannot exceed 28500 for. Should you consider a lump sum pension withdrawal for your 500K portfolio.

Get Help Designing Your Plan. Depending on your income level your tax rate can be as low as. Taxpayers age 65 or older can exclude up to 8000 of income.

House Bill 67 Tech Readiness Gross. New Mexico does have a state income tax. After a 30 - year career NMERB will replace 705 of an employees pre-retirement income.

In 2022 the New Mexico Legislature passed a bill and the Governor signed that eliminates taxes on Social Security benefits for. Schwab Retirement Plan Services. 2 hours agoSANTA FE NM.

That amount increases to 20000 in 2023 and to 30000 after that. E-File Federal to the IRS for Free and Directly to New Mexico for only 1499. For tax year 2021 that.

Should you consider a lump sum pension withdrawal for your 500K portfolio. Rules for filing taxes in New Mexico are very similar to the federal tax rules. Deductions both itemized and standard match the federal deductions.

House Bill 39 GRT Deduction for Nonathletic Special Events. Beginning in 2022 up to 10000 of military retirement is tax-free. E-File Directly to the IRS State.

Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each. Ad Learn how a lump sum pension withdrawal may give you more income flexibility. Michelle Lujan Grisham a Democrat signed House Bill 163 exempting individuals with less than 100000 a year of income and couples earning less than 150000.

Ad Learn how a lump sum pension withdrawal may give you more income flexibility. New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted. Ad Help Employees Get More Out of Retirement.

How Every State Taxes Differently In Retirement Cardinal Guide

Dominic Garcia To Leave New Mexico State Pension Chief Investment Officer

Foreign Pension In 2022 The Latest On U S Taxes

States That Don T Tax Military Retirement Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/5ToolsforRetirementPlanning-3954dc7e62a04daea0c47422dd74d33d.jpg)

State Income Tax Breaks For Retirees

Military Retirement And State Income Tax Military Com

New Mexico State Veteran Benefits Military Com

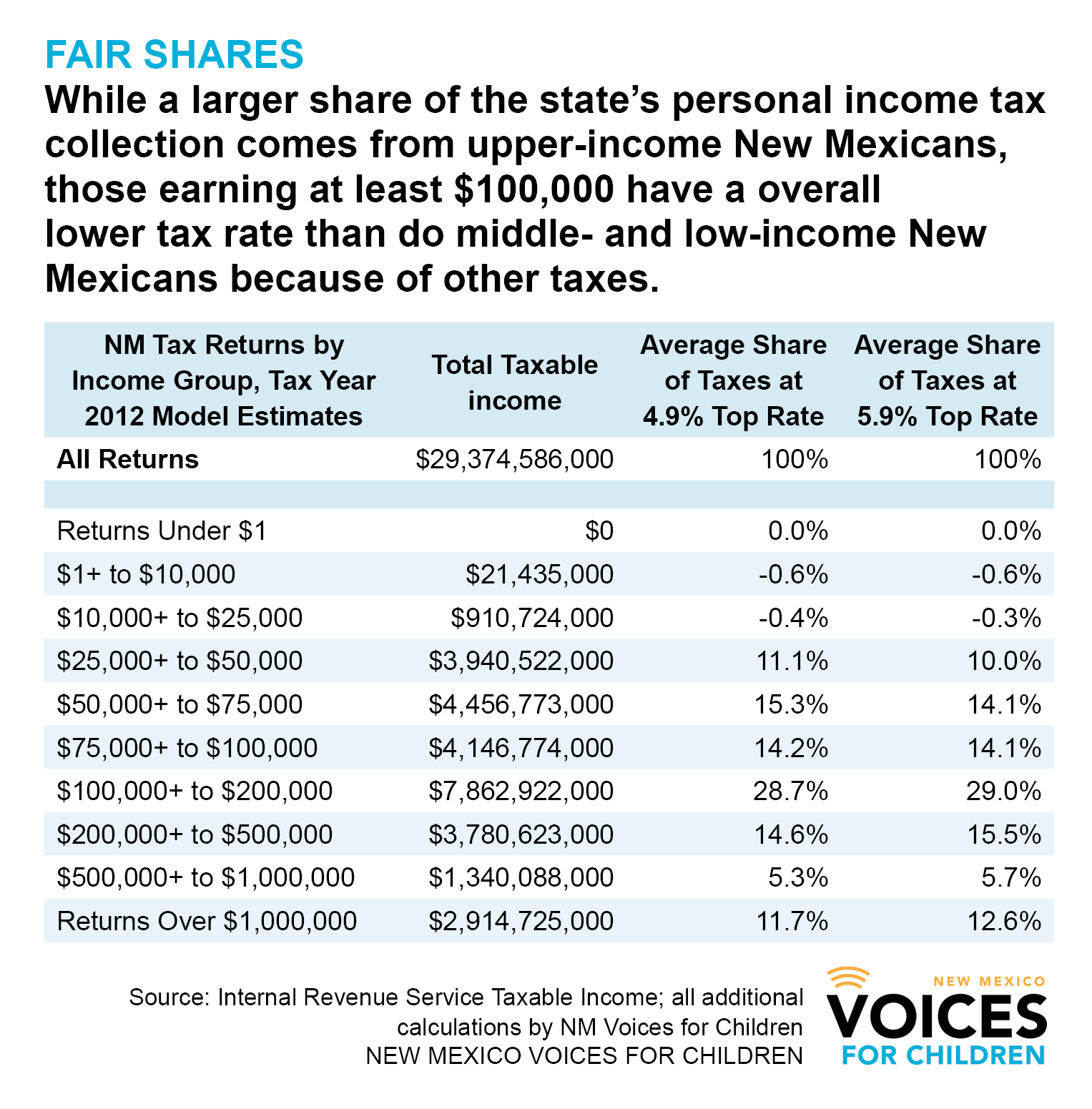

Why The Poor Pay The Highest Tax Rate In New Mexico And One Step Toward A Fix New Mexico Voices For Children

How Do State And Local Individual Income Taxes Work Tax Policy Center

The Most Tax Friendly States For Retirees Vision Retirement

![]()

Tax Friendly States For Retirees Best Places To Pay The Least

A Guide To New Mexico S Tax System New Mexico Voices For Children

New Mexico Retirement Tax Friendliness Smartasset

New Mexico Cuts Their Taxes On Retiree Benefits Retire New Mexico

States That Won T Tax Your Federal Retirement Income Government Executive

New Mexico Advances Bill Exempting Social Security From Income Taxes

New Mexico Cuts Their Taxes On Retiree Benefits Retire New Mexico